MBA Financial ROI Calculator

Calculate Your MBA Investment

Find out if an MBA is financially worth it for your specific situation

Key Metrics

Recommendation

Spending $80,000 to $150,000 on an MBA isn’t just a big decision-it’s a life-altering financial gamble. You’re giving up two years of income, taking on debt, and betting that your future self will earn enough to make it all worth it. So, is an MBA worth it financially? The answer isn’t yes or no. It’s it depends.

What you actually pay for an MBA

Most people think of tuition when they calculate MBA costs. That’s only part of the story. In the U.S., top programs like Harvard or Stanford charge around $80,000-$120,000 in tuition alone. In Europe, programs like INSEAD or London Business School run $70,000-$100,000. In Australia and New Zealand, expect $40,000-$70,000 for a full-time MBA.

But tuition isn’t the biggest cost. It’s the salary you give up. If you’re making $70,000 a year before your MBA, walking away for two years means losing $140,000 in income. Add living expenses-rent, food, insurance, books-and you’re looking at $200,000-$250,000 total out of pocket for a top program. That’s not a loan. That’s a down payment on a house.

What you get back: Salary jumps and promotions

Here’s where things get interesting. Graduates from top 20 MBA programs in the U.S. see median starting salaries of $145,000, according to the 2024 GMAC survey. That’s not a small bump. It’s a 75-100% increase from pre-MBA earnings. In tech, finance, and consulting, bonuses can add another $25,000-$50,000 in the first year.

But here’s the catch: not everyone gets that. If you’re switching from retail management to corporate strategy, your jump might be $20,000-$30,000. If you’re staying in the same industry, you might only get a 10-15% raise. The biggest financial gains go to people who change industries, roles, or geographies.

Real-world example: Sarah, a project coordinator in Auckland, made $65,000 a year. After her MBA at Auckland University Business School, she moved into corporate development at a multinational firm. Her salary jumped to $110,000. That’s a $45,000 increase. She paid $55,000 in tuition and lost $130,000 in income. It took her 3.5 years to break even. After that, she started making $45,000 more every year than she would have without the degree.

Who loses money on an MBA

Not everyone wins. The biggest losers are people who:

- Go to low-ranked programs with weak job placement

- Stay in the same company without a role change

- Take on massive debt without a clear post-MBA plan

- Wait too long to return to work after graduation

Some MBA grads from regional schools end up making $75,000-$85,000 after graduation-only slightly more than before. When you factor in lost income and interest on loans, they’re still $50,000-$80,000 behind five years later. That’s not a career boost. That’s a financial hole.

One 2023 study from the University of Chicago found that graduates from programs ranked outside the top 50 in the U.S. had a negative ROI after 10 years. Their earnings didn’t outpace what they would’ve made without the degree. That’s not a failure of the person. It’s a failure of the program’s network, brand, and job support.

Alternative paths that beat an MBA financially

You don’t need an MBA to earn $120,000+ a year. Many people do it without ever stepping into a classroom.

- Software engineers with 5 years of experience in Silicon Valley make $150,000-$200,000. No MBA needed.

- Freelance consultants with strong portfolios charge $100-$200/hour. They earn more than MBA grads in their first year.

- Supply chain managers in logistics companies in Australia earn $110,000+ with a bachelor’s degree and certifications like CSCP.

- Project managers who earn PMP certification spend $500-$1,000 and get a 20% salary bump.

The MBA isn’t the only path to higher pay. It’s just the most expensive one. If you’re already in a high-growth field like tech, data, or digital marketing, an MBA might not add much. But if you’re stuck in a slow-moving industry with rigid promotion paths-like manufacturing, government, or traditional retail-it can be the only way out.

When an MBA makes financial sense

Here’s the sweet spot: you’re under 30, making $50,000-$70,000, and you’re in a field where promotions require formal credentials. You want to move into leadership, strategy, or corporate finance. You’re willing to relocate. You can get funding-scholarships, employer sponsorship, or a program with strong ROI.

Top programs offer scholarships that cut costs by 30-50%. Many companies sponsor MBAs if you promise to return for 2-3 years. If your employer pays for half your tuition, your financial risk drops by half. That changes everything.

Also, geography matters. An MBA from a Canadian school might cost $40,000 and land you a $100,000 job in Toronto. An MBA from a U.S. school might cost $120,000 and land you $150,000 in New York. But if you’re from New Zealand and move to Singapore, your MBA might unlock a $130,000 job with tax-free income. That’s a game-changer.

The hidden financial benefits no one talks about

Money isn’t the only return. An MBA gives you:

- A network of people who can refer you to jobs, investors, or partners

- Access to alumni networks that open doors you didn’t know existed

- Credibility with clients and employers who trust the brand

- Confidence to negotiate salaries and ask for promotions

One graduate from Melbourne Business School told me he got his first VP role because the CEO recognized his school’s name on his resume. He didn’t have more experience than the other candidates. He had a brand behind him. That’s intangible-but it’s worth thousands in salary increases over time.

These benefits don’t show up in salary reports. But they show up in promotions, raises, and opportunities that never appear on job boards.

How to calculate your personal ROI

Here’s how to figure out if an MBA makes sense for you:

- Estimate your pre-MBA income. Include bonuses.

- Estimate your post-MBA income. Use Glassdoor, LinkedIn Salary, or alumni data from your target school.

- Calculate lost income: (2 years) × (pre-MBA salary)

- Add tuition, fees, living costs.

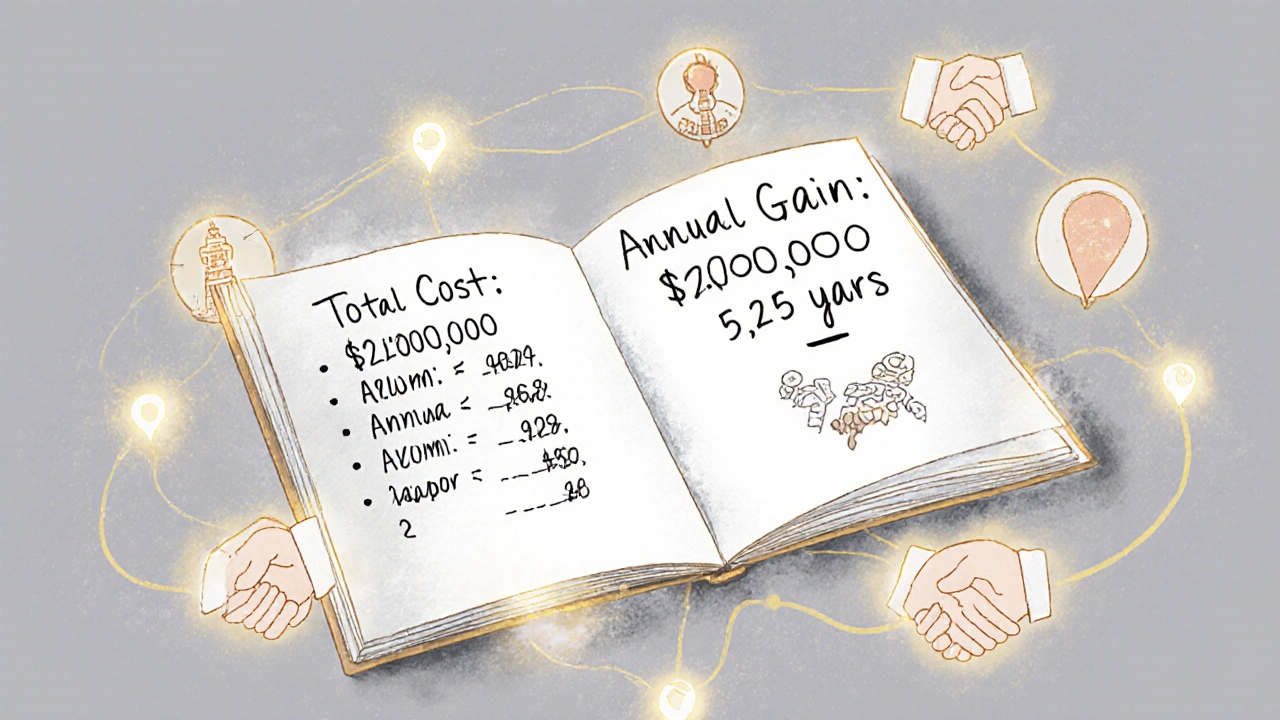

- Total cost = lost income + tuition + expenses

- Annual gain = (post-MBA salary) − (pre-MBA salary)

- Break-even point = Total cost ÷ Annual gain

If your break-even point is under 4 years, you’re in a good spot. If it’s over 7 years, think again.

Example: You make $60,000 now. You’ll make $100,000 after. You lose $120,000 in income. Tuition is $60,000. Living costs: $30,000. Total cost: $210,000. Annual gain: $40,000. Break-even: 5.25 years. That’s acceptable if you plan to work 15+ more years.

What to do if you’re unsure

Don’t jump into an MBA blindly. Try this instead:

- Take a single course in finance or strategy online (Coursera, edX). See if you like it.

- Ask your manager if they’d sponsor you for a part-time MBA or executive program.

- Talk to 5 people who did an MBA in your industry. Ask: "Would you do it again?" and "What was the biggest surprise?"

- Apply to one program. See if you get a scholarship. If not, reconsider.

The MBA isn’t a trap. But it’s not a guaranteed paycheck either. It’s a tool. And like any tool, it’s only worth it if you know how to use it-and if you actually need it.

Is an MBA worth it if I’m over 35?

It depends on your goals. If you’re aiming for a major career shift into corporate leadership, finance, or consulting, an MBA can still open doors. But the financial return is slower. You’ll have fewer years to recoup your investment. Many people over 35 choose part-time or executive MBAs to keep working while studying. These programs cost less in lost income and often come with employer support.

Can I get an MBA without going into debt?

Yes. Many companies sponsor MBAs for high-potential employees. Scholarships are common at top schools-some cover 50-100% of tuition. Programs in Europe and Asia often cost less and offer higher ROI. You can also work while studying in a part-time or online MBA. That way, you earn income while you learn. The key is planning: apply for funding before you enroll, and don’t assume loans are your only option.

Do I need a top-tier MBA to make money?

Not always. While top programs have the highest average salaries, many mid-tier schools deliver strong ROI, especially if you stay local. For example, an MBA from Auckland University of Technology or Victoria University of Wellington can lead to a $90,000+ salary in New Zealand, with lower costs and strong regional networks. The brand matters more in global industries like consulting or finance. In local industries, skills and experience often outweigh the school name.

How long does it take to break even on an MBA?

On average, it takes 3-5 years for graduates of top programs to break even. For mid-tier programs, it can take 5-8 years. If your break-even point is longer than 7 years, ask yourself: "Will I still be in this role in 10 years?" If the answer is no, the MBA might not be worth the cost. Use the ROI formula: total cost divided by annual salary increase.

What if I don’t get a job after my MBA?

This happens more than people admit. About 10-15% of MBA graduates from non-top schools struggle to find full-time roles in their target field. If you’re considering an MBA, research the school’s employment report. Look for the percentage of graduates employed within 3 months, and check the industries and job titles listed. If the data looks vague or overly optimistic, dig deeper. Talk to alumni. Ask: "How did you find your job?" If most say they used personal connections, not the career center, that’s a red flag.